INSIGHTS

Tax Compliance Calendar for AUGUST 2022

Tax Compliance Calendar for AUGUST 2022 Compliance Due Date Concerned (Reporting) Period Compliance Detail Applicable To 7th August July 2022 TDC

CORPORATE LAW UPDATES AUGUST 2022

CORPORATE LAW UPDATES AUGUST 2022 CIRCULAR NO. SEBI/HO/IMD/DF2/CIR/P/2022/102, DATED 28-07-2022 SEBI extends timeline for implementation of direct

INCOME TAX REGULATORY UPDATES AUGUST 2022

INCOME TAX REGULATORY UPDATES NOTIFICATION NO. 04/2022, DATED 26-07-2022 CBDT notifies procedures for allotment of PAN to an LLP incorporated by

GST REGULATORY UPDATES AUGUST 2022

GST REGULATORY UPDATES AUGUST 2022 GSTN implemented mandatory mentioning of 6 digit HSN codes in GSTR-1 for turnover above 5 crore Editorial Note:

Tax Compliance Calendar for JULY 2022

Tax Compliance Calendar for JULY 2022 Compliance Due Date Concerned (Reporting) Period Compliance Detail Applicable To 7th July May 2022 April-June

CORPORATE LAW UPDATES JULY 2022

CORPORATE LAW UPDATES JULY 2022 GENERAL CIRCULAR NO. 07/2022, DATED 29-06-2022 MCA further extends the timeline for filing of Annual Return by LLPs

INCOME TAX REGULATORY UPDATES JULY 2022

INCOME TAX REGULATORY UPDATES CIRCULAR NO. 11/2022, DATED 03-06-2022 CBDT issues clarifications on Form 10AC issued till 03-06-2022; list down

GST REGULATORY UPDATES JULY 2022

REGULATORY UPDATES NOTIFICATION NO. 16/2015-20, DATED 01-07-2022 Amendment in FTP to extend IGST & Compensation Cess exemption on imports under

Tax Compliance Calendar for June 2022

Tax Compliance Calendar for June 2022 Compliance Due Date Concerned (Reporting) Period Compliance Detail Applicable To 7th June May 2022 TDC/TCS

CORPORATE LAW UPDATES JUNE 2022

CORPORATE LAW UPDATES CIRCULAR NO. SEBI/HO/IMD/ FPI&C/CIR/P/2022/57, DATED 29-04-2022 SEBI modifies guidelines for FPIs, Designated Depository

INCOME TAX REGULATORY UPDATES JUNE 2022

INCOME TAX REGULATORY UPDATES Higher rate of withholding tax on payments to non-filers of tax returns – Central Board of Direct Taxes (CBDT) issues

GST REGULATORY UPDATES JUNE 2022

GST REGULATORY UPDATES Central Board of Indirect Taxes & Customs (CBIC) extends the due date for payment of GST & filing Form GSTR-3B

Independent Director

INTRODUCTION An Independent Director is a Non-Executive Director who does not have a material or pecuniary relationship with company, except sitting

CONVERSION OF LOAN INTO EQUITY

CONVERSION OF LOAN INTO EQUITY INTRODUCTION When converting debt to equity, the lender converts a loan amount into equity shares. No cash exchange

CLOSURE OF COMPANY

Closure of the Company Introduction: Chapter XVIII of the Companies Act, 2013 (Act) deals with removal of Names of Companies From the Register of

Opening a Branch Office

SETTING UP BRANCH OFFICE 'Branch Office' in relation to a company, means any establishment described as such by the company. As per Notification

BRIEF INTRODUCTION OF FORMING SOCIETY

Introduction: There are various forms of organization through which one can carry out activity relating to literary, scientific, charitable and

Passing Resolution at Board Meeting

Passing Resolution at Board Meeting Under Companies Act, 2013: Section 179 (3) The Board of Directors of a company shall exercise the following

PROCEDURE FOR APPOINTMENT OF CS/ CFO/ CEO

STEP – 1 Convene A Board Meeting: To appoint CS, CFO and CEO By giving Notice of at least 7 days. STEP – 2 Hold the Board Meeting: At the Board

Form of Business Organization

Introduction A business enterprise can be owned and organized in several forms. Each form has its own merits and demerits. The ultimate choice of

- 1

- 2

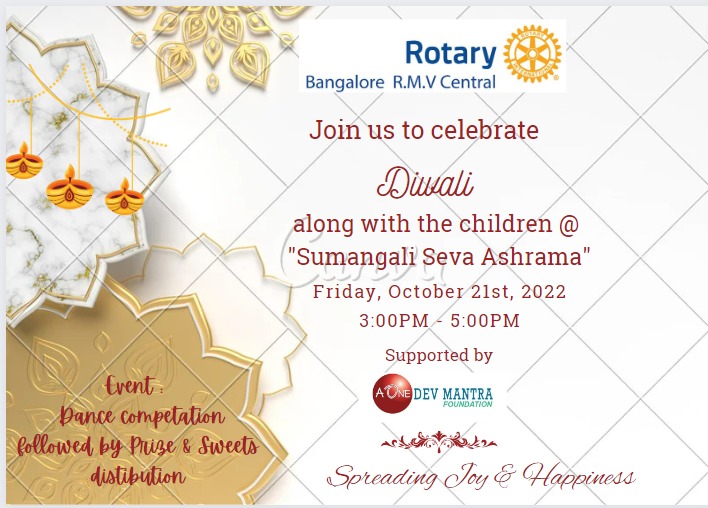

JOIN US TO CELEBRATE DIWALI

JOIN US TO CELEBRATE DIWALI